We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\). If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers. For League Recreation’s Product A, a premium baseball, the selling price per unit is $8.00.

Calculate Total Variable Cost

More specifically, using contribution margin, your business can make new product decisions, properly price products, and discontinue selling unprofitable products that don’t at least cover variable costs. The business can also use its contribution margin analysis to set sales commissions. To calculate contribution margin, a company can use total revenues that include service revenue when all variable costs are considered. For each type of service revenue, you can analyze service revenue minus variable costs relating to that type of service revenue to calculate the contribution margin for services in more detail.

Contribution Margin for Overall Business in Dollars

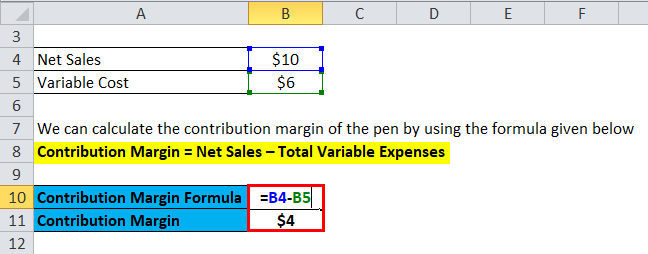

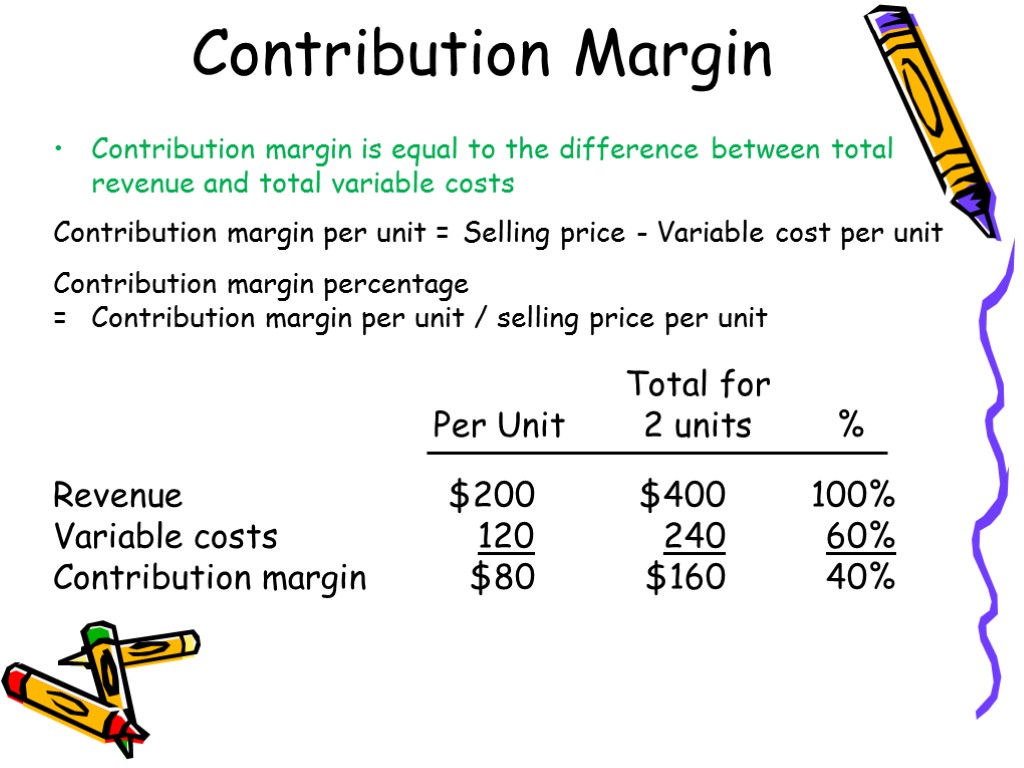

To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit. For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit. The formula to calculate the contribution margin is equal to revenue minus variable costs. For example, raising prices increases contribution margin in the short term, but it could also lead to lower sales volume in the long run if buyers are unhappy about it.

Great! The Financial Professional Will Get Back To You Soon.

Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio. Calculations with given assumptions follow in the Examples of Contribution Margin section. Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows. Contribution margin calculation is one of the important methods to evaluate, manage, and plan your company’s profitability. Further, the contribution margin formula provides results that help you in taking short-term decisions.

Formula For Contribution Margin

- Selling price per unit times number of units sold for Product A equals total product revenue.

- It is important to note that this unit contribution margin can be calculated either in dollars or as a percentage.

- Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable costs.

- This is because the contribution margin ratio lets you know the proportion of profit that your business generates at a given level of output.

- In such cases, the price of the product should be adjusted for the offering to be economically viable.

Fixed costs are the costs that do not change with the change in the level of output. In other words, fixed costs are not dependent on your business’s productivity. Direct Costs are the costs that positive and negative reviews can be directly identified or allocated to your products. For instance, direct material cost and direct labor cost are the costs that can be directly allocated with producing your goods.

It is the monetary value that each hour worked on a machine contributes to paying fixed costs. You work it out by dividing your contribution margin by the number of hours worked on any given machine. A contribution margin analysis can be done for an entire company, single departments, a product line, or even a single unit by following a simple formula. The contribution margin can be presented in dollars or as a percentage. The contribution margin may also be expressed as fixed costs plus the amount of profit.

As a business owner, you need to understand certain fundamental financial ratios to manage your business efficiently. These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues. Alternatively, the company can also try finding ways to improve revenues. For example, they can simply increase the price of their products.

Furthermore, a higher contribution margin ratio means higher profits. This means that you can reduce your selling price to $12 and still cover your fixed and variable costs. A key characteristic of the contribution margin is that it remains fixed on a per unit basis irrespective of the number of units manufactured or sold. On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs. It is important to note that this unit contribution margin can be calculated either in dollars or as a percentage. To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers.

At breakeven, variable and fixed costs are covered by the sales price, but no profit is generated. You can use contribution margin to calculate how much profit your company will make from selling each additional product unit when breakeven is reached through cost-volume-profit analysis. Therefore, the unit contribution margin (selling price per unit minus variable costs per unit) is $3.05.

With that all being said, it is quite obvious why it is worth learning the contribution margin formula. The following examples show how to calculate contribution margin in different ways. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs. However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low.